Saving Tricks: Monzo Pots and IFTTT

It can be difficult, particularly during recent times of inflation to get by never mind trying to save money. In my opinion, saving is a luxury. I'm in a fortunate position now, but it wasn't too long ago that I was living month to month trying to work my way out of an overdraft.

For the past few years, however, I've begun adopting a few small savings tricks enabled by my bank Monzo and IFTTT which I find enable me to make my money work for me, and allow me to be more intentional with my spending (and saving).

Pots

One of my favourite things about Monzo is the ability to move money between pots easily. Monzo pots allow you to separate money into pots so you know where your money is, and what it's for. They are just living savings accounts but are well integrated into your main account and you can easily see all of your account statuses in one place.

When I get paid I immediately divide my money into pots for bills, groceries, emergency funds, individual savings pots (holiday? garden furniture? whatever I'm saving for at the time), and a dedicated gifts pot. This then leaves "the rest" as my general spending money for that month, and anything that I have left from the previous month then goes into my ISA where I invest it in stocks and shares.

I found that visualising my bills has helped me to cancel subscriptions that I didn't need anymore, focus on paying off loans quicker, and try to make my monthly outgoings as small and intentional as possible.

The savings pots go without saying, but a nice part about them is that you can also set a goal which makes it easy to see at a glance how close you are to your target, which can be motivating in itself. The interest in these pots can also build up nicely too!

The gifts pot is a bit random, but I have a big immediate family that I buy gifts for each year. I've intentionally kept this money separate so that when a birthday or Christmas comes around it doesn't feel like I'm breaking the bank because I've got the money put aside specifically for it.

Budgets

Monzo also gives you the option to set a monthly budget; and within that monthly budget, you can set individual budgets for specific types of spending (travel, eating out (which we break almost every month...), shopping, bills, etc). If you're trying to cut down on eating out, for example, it can help to visualise how much each month you're spending on that and be more intentional about cutting it down.

When you set these it will also give you an overview of how much money you've got left to spend that month, and whether there's a risk you'll overspend. Those little things make it much easier to see how well you're doing, especially if you're trying to save more money.

I will note that if you use credit cards, such as an American Express card, that it does take away some of that visibility of the Monzo categories, as you'll generally pay off the credit card as a whole, rather than individual payments. More recently, you can connect your credit card to Monzo to visualise everything in one app, but I still find the categorisation across cards doesn't feed as well into budgeting as it used to for me.

Automated Savings

This is the part that I enjoy the most because it's possible to configure automated savings in ways that you are comfortable with and if it's not working? Change it.

I've had three automated savings mechanisms set up for the last few years:

- Monzo - Round Ups

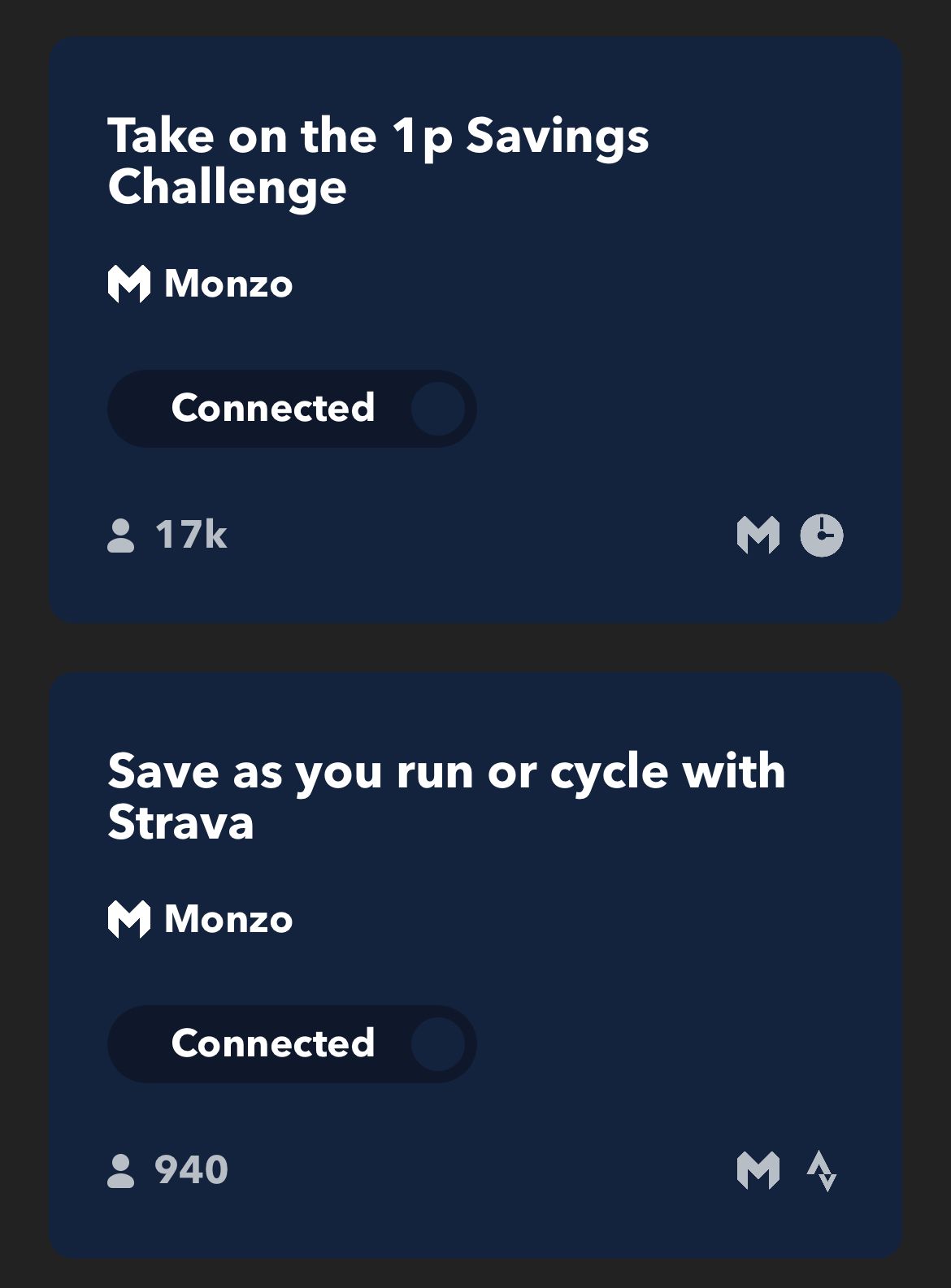

- IFTTT - 1p Savings Challenge

- IFTTT - Save as you run

The Monzo round-ups are built into the banking app, and do what they say on the tin. When you spend £1.03, it will automatically round up the rest (to the next pound) into a savings pot of your choosing. In this case, it would put 97p into my dedicated savings pot. These kinds of savings are close enough to what you are spending, that it's possible to miss that you're even spending it and they can add up pretty quickly.

IFTTT

The IFTTT app integrates with the Monzo banking app (and maybe other banks too? I'm not sure, your mileage may vary) and means "If this, then that". So if a specific criteria is met, then it will automatically sort your money for you.

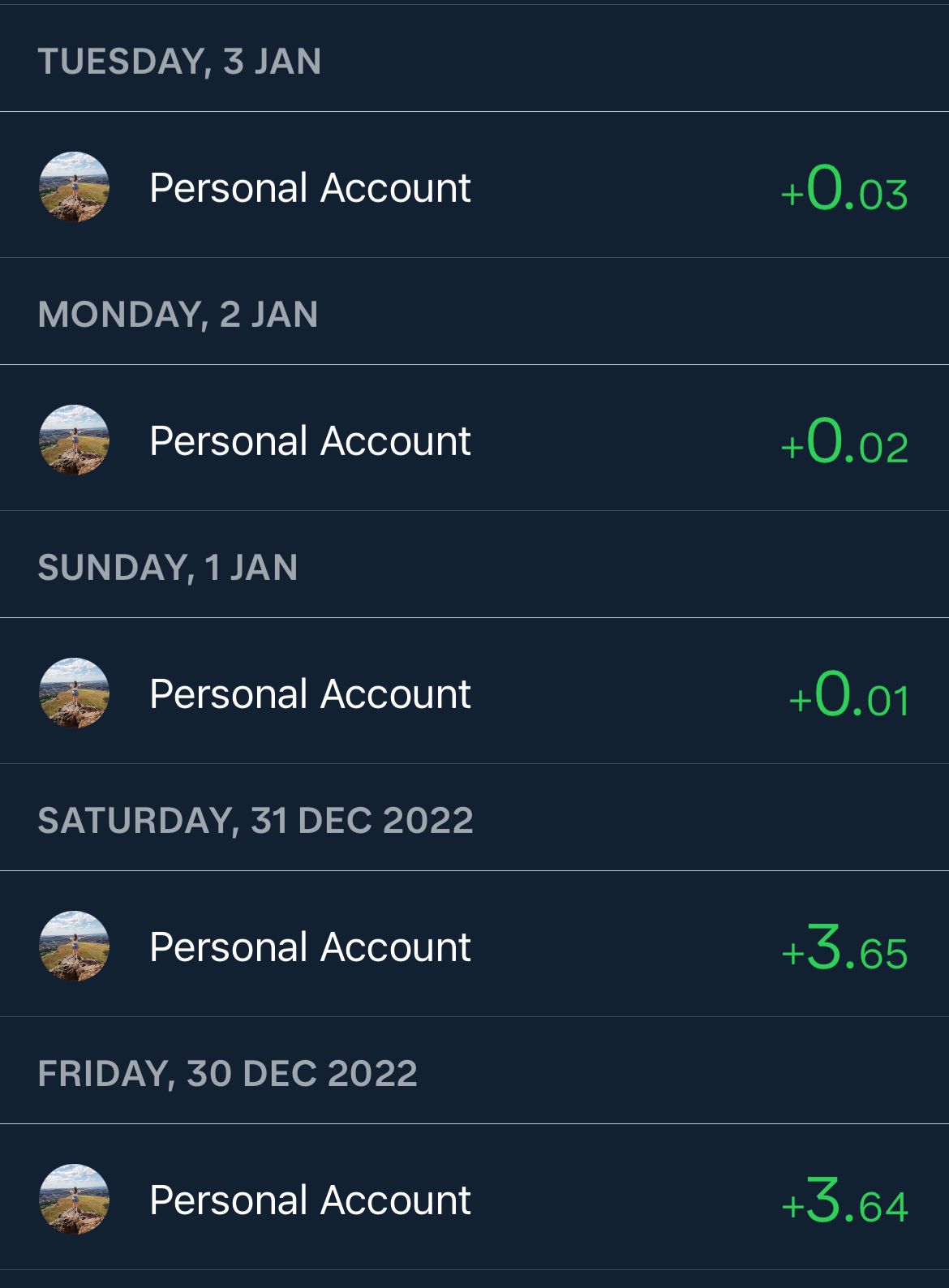

1p Savings Challenge

The 1p savings challenge will increase the amount of money it puts into savings by 1 pence every day, so on the first of January it will put £0.01 into your specified savings pot, and as the year goes on you'll put more into savings, until by the end of the year it's putting over £3 a day into savings before resetting on the 1st of January again.

Save as you Run

It's also possible to connect the IFTT app to your Strava account. If you're interested in running and hiking like I am, you'll probably know that if it's not on Strava then it doesn't count... right?! Well, having this connected means that if I were to run say a 5km run, then IFTT would translate that into £5 into my savings pot. This is quite a fun way to not only improve your fitness but also save money at the same time.

This has been particularly effective for me when I've been trying to save up for something like a new running watch, or maybe a new pair of shoes. I can create a dedicated Monzo Pot with a goal of the cost of the shoes I want to buy, and as I train I can build up my savings specifically for that purchase automatically.

More Saving Tips

I'm in no way affiliated with Monzo or IFTT, but these are a few tips and tricks that I've found myself sharing with others in recent days that I thought were worth sharing in a more permanent place. I will also note that Monzo specifically is only available as a UK bank account right now, and I'm not sure how any of these tricks might apply to other banks.

If you've got other savings tips and tricks, I'd love to hear about them!

All the best,

Donna